In 2006, everything was rosy: on the eve of Bulgaria's accession to the EU, people and companies expected that everything would change by magic, incomes and sales would soar to European levels and politicians would become less corrupt and more concerned with the problems of the state.

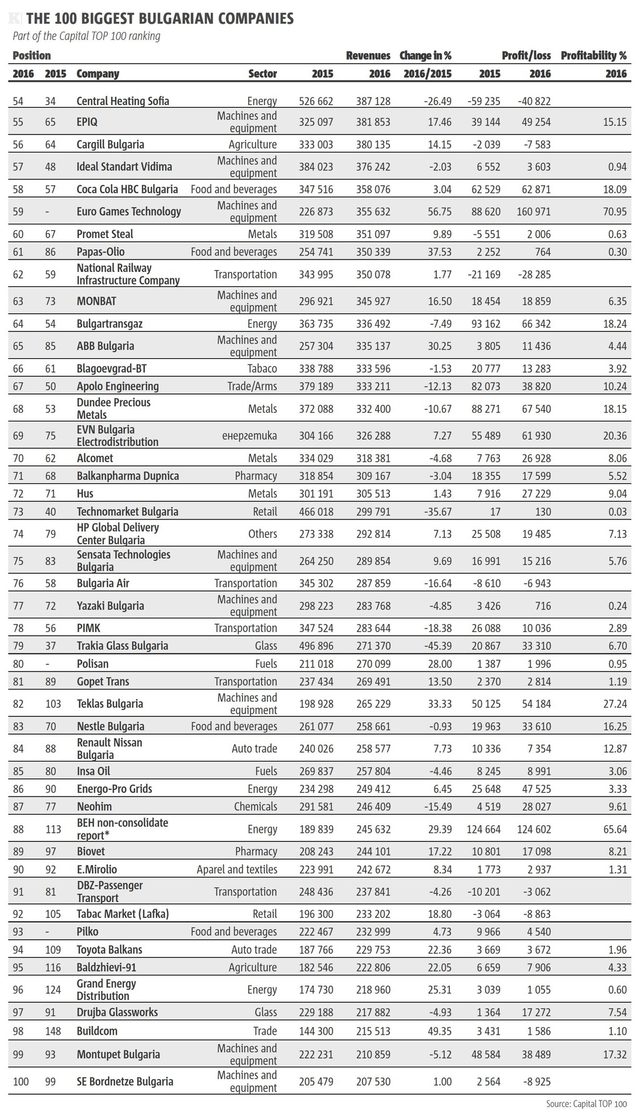

Ten years later, there is a change but not a gigantic one. The business community survived one of the big global crises, a property bubble burst out and, slowly, Bulgaria has begun finding its business niche - mechanical engineering and high technologies.

A dozen of differences

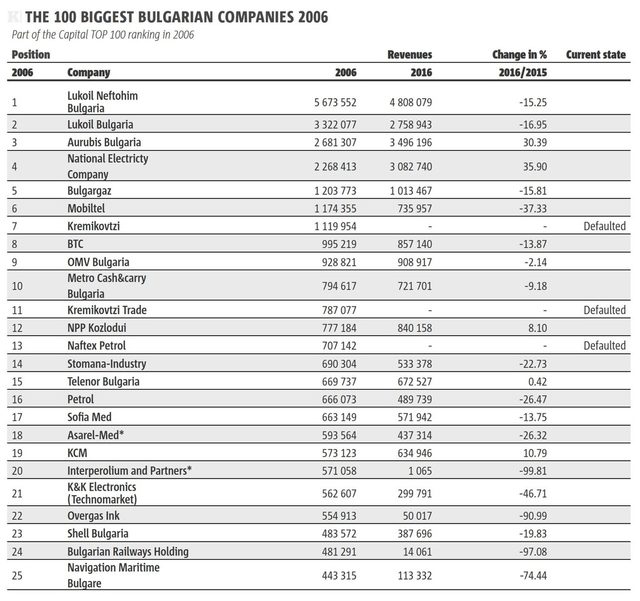

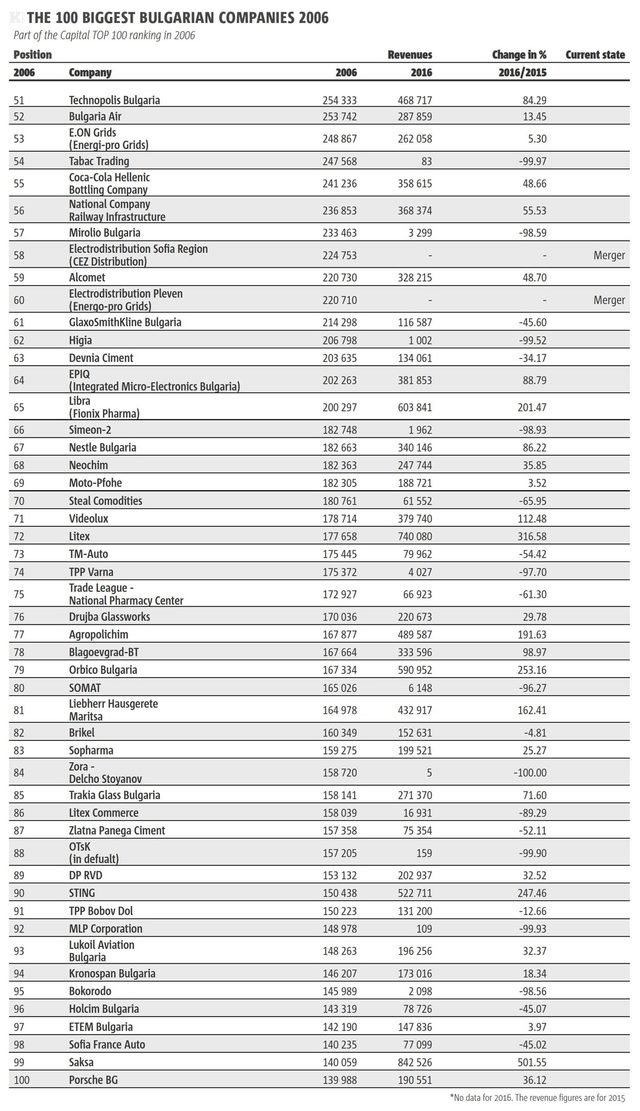

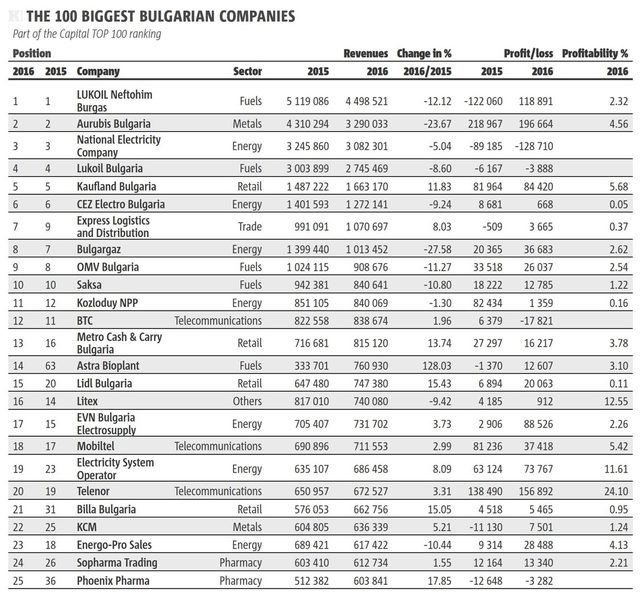

In 2004-2006 the country's economic growth rate peaked at more than 6% annually and the revenues of the K100 companies increased by 20-25% on the average. While ten years ago the turnover of the 10 biggest companies was 20 billion levs, now it is at the same level, having marked zero growth. It seems that the giants, with few exceptions, have not grown at all. Oil refinery Lukoil Neftohim Burgas is the leader again but its revenue is even smaller due to low fuel prices. However, there are some differences.

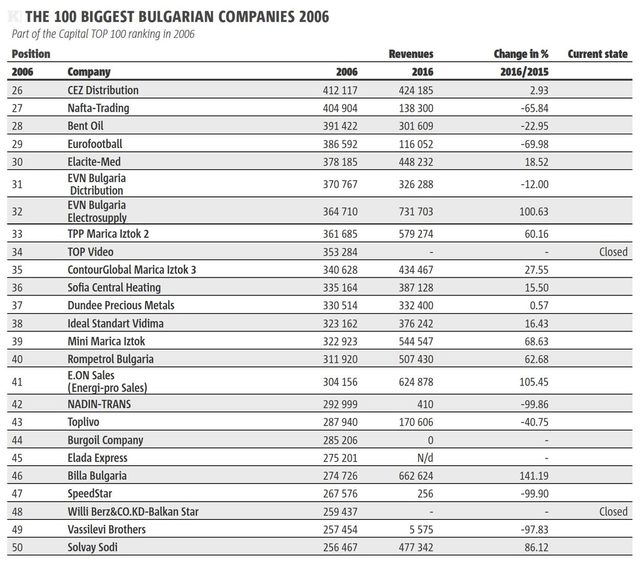

First, copper producer Aurubis Bulgaria climbed to the second position following capacity expansion. Second, for several years now the telecommunications companies have not reported a turnover of 1 billion levs after competition and regulations reduced prices for consumers. Third, Metro Cash&Carry is no longer the top chain, having been ousted by Kaufland retailer with impressive revenues exceeding 1.66 billion levs. The other company of Germany's Schwarz Group, Lidl retailer, is just slightly behind Metro. Billa retail chain, although somewhat behind, has increased its turnover more than 2.5 times.

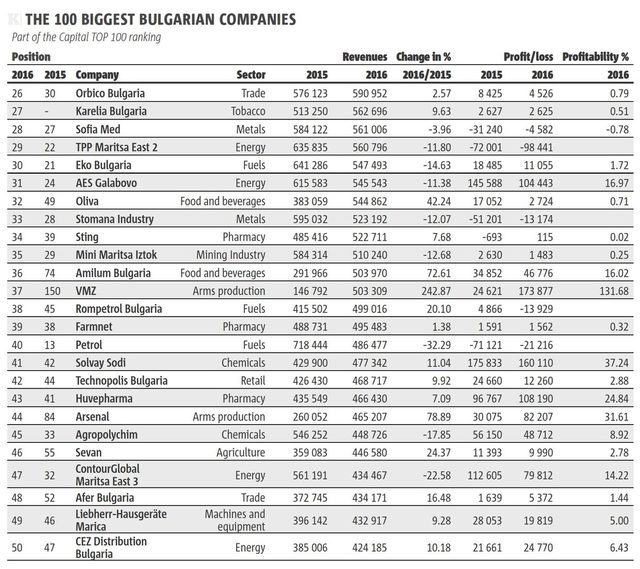

In 2006, there were 10 state or municipally-owned companies among the top 100, while today their number is 11. This is explained by the fact that only Bulgartabac went into private hands during the period, while the state set up gas transmission company, Bulgartransgaz as a result of the split of gas monopoly Bulgargaz into two separate entities. At the same time, due to armed conflicts, ammunition manufacturer VMZ Sopot has grown sufficiently to join the club of the biggest.

The parity between companies with foreign and local ownership has been preserved. Yet, businesses have grown over the past 10 years. This is confirmed by the rise in the revenues of the top 100 companies from a combined total of 47 billion levs in 2006 to an aggregate turnover of 58 billion levs of the companies in the new sample of giants.

The group of companies that have closed down or reduced their business is relatively big. Apart from Kremikovtzi steel mill, OTsK - Kardzhali lead and zinc smelter also went bankrupt. The biggest road carrier, SOMAT, lost its business due to problems

of its foreign owner. Varna thermal power plant has suspended operations for some years now due to non-compliance with environmental requirements. The cement plants have cut their business activity by half at least.

Due to record-high international prices of metals and fuels in 2006 many producers and traders in fact had higher sales at the time. Of course, there are exceptions but they are due to additional investments, for example, in the non-ferrous metals smelter KCM and aluminium products manufacturer Alcomet. The business of Navigation Maritime Bulgare (Navibulgar) shrank to a quarter of its previous value.

There were reshuffles in the lines of business within some companies. For example, the revenues of Eurofootball betting operator fell by more than two thirds most probably due to the online gambling segment but the decline was compensated by the lottery games business of the owner, which even exceeded Eurofootball's turnover.

Several industrial enterprises have grown considerably, such as Liebherr Bulgaria (manufacturer of refrigerating and freezing equipment), the glass plants of Turkey's Sisecam and EPIQ Botevgrad, which now has a new owner and a new name. The business of Saksa wholesale fuel trader has grown several times, while many other intermediaries, who used to work with the company, have disappeared. Today, the cigarette traders have been replaced by Express Logistics and Distribution company.

There are many new industrial enterprises that have a significant presence in the ranking now compared to 10 years ago. Today, their number is several times higher in the Top 100 and even in the Top 300 group.

Higher revenues in the past

Surprisingly, the companies, which made the top 10 and even the ones of the top 100 group had higher revenues than those ranking at the top of the lists now. Back then, the sales of each of the 10 giants exceeded 1 billion levs (compared to only eight companies reporting sales in excess of one billion levs in 2016) and together they generated a revenue of 28 billion levs. The total revenue of the top 100 companies stood at 64.5 billion levs in 2006, i.e. 6.5 billion levs higher than the current volume.

Of course, the difference is due to the fact that oil prices topped 100 USD/barrel in 2011, while now they are half that amount. The international prices of metals were record high at that time as well. In fact, most companies now have higher revenues with the exception of these two groups. Both export-oriented companies and those working for the domestic market are performing better.

There are two visible changes in the top 10: the absence of wholesale fuel trader Naftex Pertol, which went bankrupt, and the drop in the then nine-digit turnover of Overgas Inc., which was one of the three natural gas importers in Bulgaria at that time.

Another difference is that in 2011 the damage inflicted by the crisis could still be seen in the profit figures: every fifth of the top 100 companies reported a loss at the time. Now, 84 of the top 100 companies have positive financial results. Apart from this, there is no big difference between the companies featuring on the top 100 list. The Carrefour franchise, operated through KMB Bulgaria, has declared bankruptcy in the meantime.

By 2011, grain traders had already joined the top 100 list on the back of EU agricultural subsidies. Construction was not at its peak then and it is not now either - unlike the 2014-2015 period, when EU finding for infrastructure projects pumped up the financial statements of construction companies. Tourism companies have had no representatives in the top 100 group during these years.A representative of the high-tech sector, Hewllet Packard Global Delivery Center, entered the ranking for the first time in 2011 and continued to grow, albeit at a slower pace, in 2016.

In 2006, everything was rosy: on the eve of Bulgaria's accession to the EU, people and companies expected that everything would change by magic, incomes and sales would soar to European levels and politicians would become less corrupt and more concerned with the problems of the state.

Ten years later, there is a change but not a gigantic one. The business community survived one of the big global crises, a property bubble burst out and, slowly, Bulgaria has begun finding its business niche - mechanical engineering and high technologies.