The illusory revival of coal

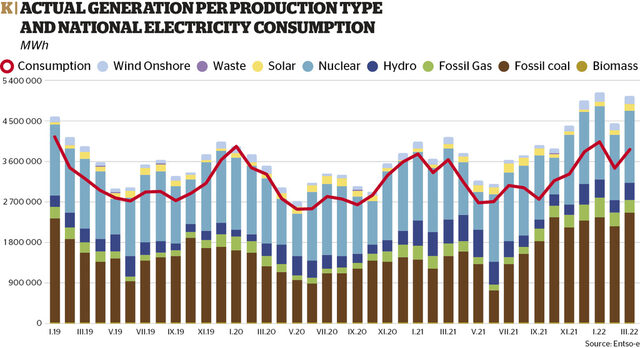

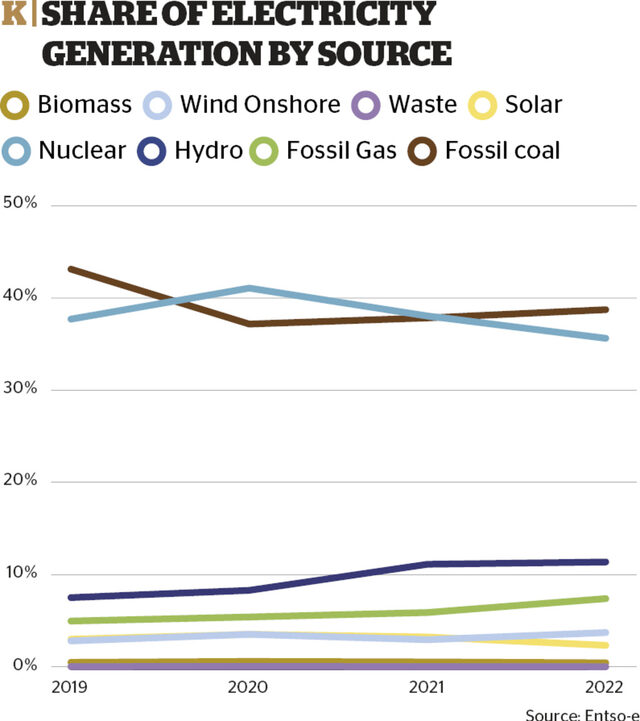

At first glance, the Bulgarian electricity market has undergone dramatic changes in the last year. Electricity production has increased by 20%, coal-fired power plants are operating at maximum capacity, and hydropower plants are producing 50% more energy. In reality, however, the situation is different. The country's electricity consumption is almost unchanged from pre-coronavirus levels, the share of coal power is increasing slightly after a record low 2020, but remains below its previous levels.

Virtually all of the change is mainly due to electricity exports, which have been growing at a huge rate since mid-2021 on their own. In the first three and a half months of this year alone, as much electricity has been exported as in the whole of 2020, or 25% of all production. This is what makes it necessary to run more capacity in Bulgaria, even though the domestic market does not need this energy.

Because of the overall increase in production, the share of coal-fired power remains relatively unchanged, although the thermal power plants are operating almost at maximum.

With the expected normalization of electricity prices in the coming months and the commissioning of significant amounts of renewable energy capacity, the situation in the region may change. Exports are likely to decrease as neighboring countries will produce their own energy. And this will force some of the plants (coal and gas-fired) to cut back as their output is the most expensive.

Military strike leads to electric shock

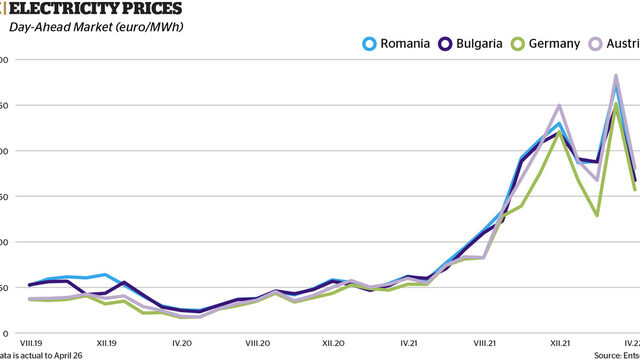

A significant part of electricity in EU member states is generated from natural gas, following the massive closure of coal-fired power plants. This is precisely why the effect of the rise in natural gas prices is being passed on directly to the electricity market, especially in Europe.

These trends were very pronounced at the end of 2021 when average electricity prices passed EUR 200/MWh. Then, in January and February, there was some calming of tensions in the sector and an expectation of gradual normalisation. However, this was interrupted by the Russian invasion of Ukraine, with the military strike causing a new shock to the electricity market. As a result, record-high electricity prices were recorded across Europe in March.

In Bulgaria, which is a net exporter of electricity, the situation is similar. Because of the connectivity with Romania and Greece, nearly 2,000 megawatts (as much as the full capacity of Kozloduy nuclear power plant) are exported every hour and, accordingly, the price on the domestic market equals that in the region. Without Bulgarian energy, however, South-East Europe would suffer even higher electricity prices.

Since the beginning of April, in line with falling natural gas prices and warming weather, electricity has started to get cheaper. It is likely that the average values for the month will be the lowest since September. But they will remain high nonetheless. A significant change can be expected towards the end of the summer when many new renewable energy source capacities will be commissioned. It is indicative in this direction that even by mid-April, a 20-25% increase in wind and solar production in the country has already been reported. This will certainly lower average energy prices for businesses.

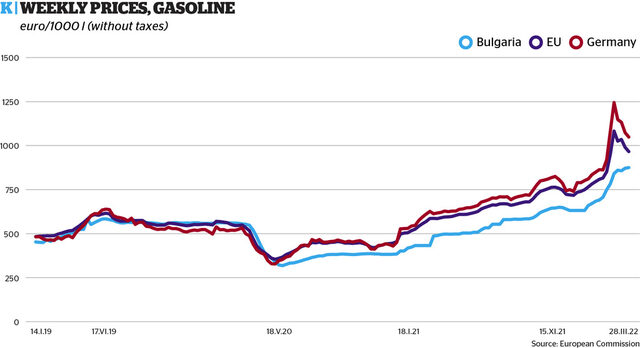

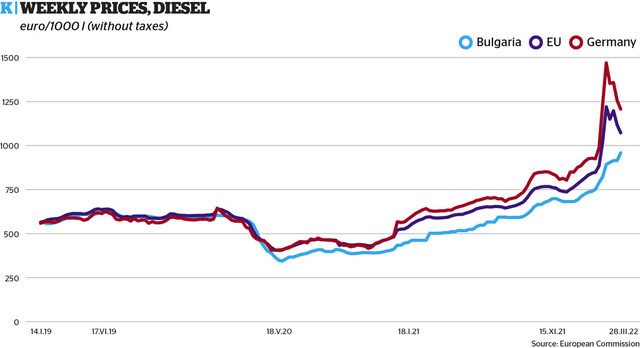

The fuel race

Even without the war in Ukraine, liquid fuels (petrol and diesel) in Europe had started to rise from the beginning of 2021. Producer price data shows that there was an almost 50% increase in the last year alone. Of course, this is from the extremely low base of pandemic-marred 2020. But still, at the end of last year fuel prices (excluding taxes and fees) were already higher than in 2019. The invasion of Ukraine by Russian troops accelerated the trend extremely, leading to record high fuel prices in March and April.

In just a matter of weeks, producer prices for gasoline and diesel increased by more than 50% reaching historical records, even though oil quotes increased by only 35%. The explanation for this outpacing rise in oil products is the fear of traders that they could remain completely without supplies if an embargo on Russian oil exports is imposed.

Bulgaria is an exception to general market trends. First, prices of fuel here (produced mainly at the Neftochim refinery near Burgas owned by Russia's Lukoil) have not risen as sharply as in Europe. And secondly, while in recent weeks in Germany, Austria, France and other Western European countries, there has been a significant drop in prices, in Bulgaria the rise continues. The latter is hard to explain from a market perspective, as oil is back to levels of under $100 a barrel, compared with $115-120 in March. In addition, Russian Urals oil, which is what Lukoil's refinery is working with, is being sold at a $30 discount, as its buyers have become extremely few due to the sanctions against Russia. The only reasonable explanation for the current situation is the fact that Bulgarian and European ports are closed to Russian ships, making it more difficult to deliver crude to Burgas.

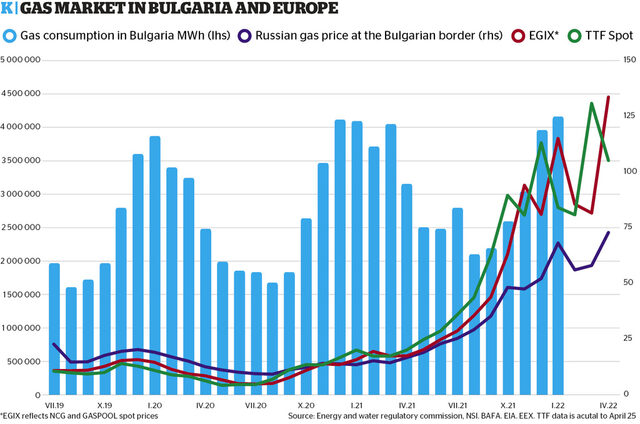

Gas prices in the rhythm of war

The European gas market has experienced its most turbulent months on record since the autumn of 2021. Prices have risen manifold in just a few months because of the rapid economic recovery following the coronavirus lockdown. But just as normalization began to trend in February 2022, Russia attacked Ukraine and the world entered a new crisis. Europe's heavy dependence on Russian gas and the threat of supply disruptions amid hostilities led to new all-time records for gas prices. Two crises have thus been superimposed on each other and have put the energy industry to an unprecedented test. Overcoming it seems achievable, but the question is at what cost.

Bulgaria is one of the European countries most dependent on Russian gas - over 90%, although domestic consumption is relatively small. The main consumers are district heating companies, chemical and glass factories. This is why consumption in winter is twice as high as in summer. The balancing of the system is achieved through the Chiren gas storage, which is filled in the summer months and used as a source in the winter. This summer, however, will see the biggest change in the Bulgarian gas market in decades - the launch of the interconnector with Greece (IGB). The country will thus be able to receive in full the contracted Azeri gas of 1 bcm per year equal to about 33% of annual consumption. This interconnector could also provide additional quantities of LNG from the US and Qatar. All this will allow Bulgaria to reduce its dependence on Russian gas to less than 50%. Public gas supplier Bulgargas' long-term contract with Gazprom, however, expires on 31 December 2022 and it is not clear how supplies from Russia will continue after that date.

In any case, the gas price for the Bulgarian market will be higher. As seen in recent months, Bulgaria has significantly lower prices compared to indices and exchanges in Europe. The reason for this is the formula in the contract with Gazprom, which, in addition to exchange quotations, includes oil and dollar indices, and is applied on an average monthly basis with a month's delay. For example, the price in force for April is based on March indicators. The price of Azeri gas that Bulgaria receives, on the other hand, is entirely dependent on oil quotations, which, despite rising in March and April, are on average 30% higher compared to the second half of 2021, while quotations at gas exchanges are up over 100%.

Replacing Russian gas with LNG at this point means higher prices. But given the market dynamics and uncertainties surrounding Russia's behaviour, it is difficult to predict exactly what will happen. On the other hand, Gazprom cannot easily redirect its exports to Asia as it does not have the necessary infrastructure. And it will look for ways to continue selling to Europe to guarantee its revenues - nearly €1 billion a day at prices of €100/MWh. The EU, for its part, has a plan to reduce gas consumption, which could put further pressure on the market and prices.