In Bulgaria, the sunflower oil business was worth close to 1.5 bln levs (767 mln euro) last year, mainly for exports, and the big players are nearly 15

The temporary panic among buyers has subsided, now the risk is that the state will intervene by stopping exports.

Panic, queues, stockpiling, scuffles in stores. March 2022 has been a crazy month for the sunflower oil market. The reason is the Russian invasion of Ukraine and the fear that the absence of a key player from the market will lead to deficits. And indeed, for a short time, prices of sunflower seeds and cooking oil shocked the world. The panic also hit Bulgaria.

Shops felt the wave first as the usual price of a litre of cooking oil (2-3 levs) has been replaced by price tags of 4-5 levs and even hit 8 levs in some places. For now, however, there is no place for continuing anxiety. The market is well prepared - behind the traders stand 15 large local sunflower oil factories and several other reliable importers from Romania, ready to deliver quickly if they see good margins in Bulgaria.

"We can't speak of a deficit, we are not in a cartel, Bulgarian oil is cheap compared to other countries," representatives of the sector say of the situation. Although Economy Minister Kornelia Ninova recently threatened that the state will hit speculators using its ministers and control commissions, the harmful phrase "export ban" has not been pronounced so far. It would sound scary for the business, which exported sunflower seed and refined sunflower oil worth 1 billion levs in 2021. Separately, the domestic market was estimated at 500 million levs.

The war and the sunflowers

The world centre of sunflower oil production is the Black Sea region - with the two key players - Ukraine and Russia, accounting for almost 80% of global exports. Bulgaria is also producing stable and growing quantities, and there was a mini-boom after the country joined the EU. The EU membership opened the way for subsidies for sunflower growers and also led to increased interest in processing sunflower seeds - a business with a higher added value.

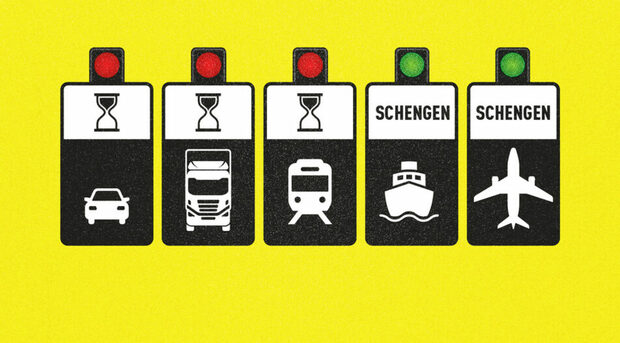

For over a month now, Ukrainian production has been almost at a standstill - ports are completely blocked and only small quantities are delivered by land. Sunflower will not be sown in the war zones for now. These facts lifted the international price of sunflower seeds and cooking oil to record highs and panic over potential shortages spilled over to producers, traders, buyers.

These records, however, are already in the past. The markets are calm, and prices, although high, are moving downwards. Their future depends on the end of the conflict in Ukraine and also on the prices of alternatives, such as soybean and palm oils.

A billion worth of business

Sunflower seed production in Bulgaria is mainly driven by exports, the domestic market's share is close to 30%.

Depending on the price, domestic sunflower oil consumption is estimated at nearly half a billion levs per year, with a small part covered by imports. In some rare cases, sunflower oil is also used for production of biodiesel.

"Bulgaria consumes nearly 100,000 tons of sunflower oil a year. This is nearly one-eighth of the quantities potentially available on the market. And it exports about 500,000 tons of sunflower oil a year," says Angel Georgiev, the owner of cooking oil producer Oliva. In 2021, Oliva had the highest gross sales in the Food and Beverage rankings in Bulgaria.

"Nearly 80,000 tons of sunflower oil are consumed on the domestic market, plus 40,000 tons of imports. Part of the sunflower oil is not used in everyday life, but goes to industrial purposes," Yani Yanev, chairman of the Oilseed Oil Producers' Association in Bulgaria, told Capital Weekly. According to him, if the companies work at the same pace and exports stay at the same levels, about 500,000 tons of sunflower seed will remain in the country by the time of the new harvest.

Although the register of the Bulgarian Food Safety Agency includes 109 companies processing and/or bottling vegetable oils, the number of large and medium producers stands around 15, and they work mainly for export. Many small sunflower oil mills meet the needs of the region in which they are located.

The top producer is Oliva, which, however, does not produce cooking oil for the Bulgarian market. Thus, the main players in the domestic market are Class, Papas, Biser Oliva. Currently, there are no financial data for 2021, but the reports in recent years show an upward trend in business. Total annual revenues of the companies in the sector reach 2 billion levs in 2020 (probably not only from sunflower oil production) and a total profit of 90 million levs. In addition, factory workers are not so many - nearly 2,000 people in the 15 companies.

The issue with the prices

The price of sunflower oil fluctuates over the years, but the more noticeable rise began in 2020 due to the poor harvest as a result of bad weather conditions.

Representatives of the sector estimate that over 80% of the cost of a litre of sunflower oil depends on the price of sunflower seed. The other factors are production costs (for pressing, extraction, refining), costs for packaging, transport and distribution, wages, taxes, profit.

The cost of producing a litre of sunflower oil has almost doubled since the end of 2021, and we trade in commodities, people in the sector said.

For companies bottling for the Bulgarian market, the wholesale price per ton of sunflower oil should be supplemented by a refining premium (for example about $200 per ton), plus all kinds of marketing and, transport costs, etc. Thus, a price of 5 levs per litre sounds normal for the current state of the market, according to estimates by representatives of the sector.

The future and the state turmoil

"We do not expect a big rise in sunflower oil prices on global markets. We expect the market to calm down. The current price of $1,900 per ton of sunflower oil stands $200 above the price of March 2021 and $500-600 lower than the first half of March 2022,", commented Oliva's Angel Georgiev.

This means that sunflower oil today does not have to be much more expensive than it was a year ago. And if the price remains high only in Bulgaria, imports from Romania will immediately follow.

The owner of Oliva is sure that there can be no deficit of sunflower oil in Bulgaria, but a possible ban on exports will be detrimental to the entire industry and will be accompanied by numerous bankruptcies. According to Georgiev's estimates, by the new harvesting season starting on August 1 the country will have in stock 200,000 tons of sunflower oil or 470,000 tons of sunflower seed.

A small unknown in the equation is the government's initiative to boost the state reserves with huge quantities of wheat, corn and sunflower worth over 1 billion levs in total. This is an operation that raises eyebrows among sunflower oil producers. First, because all the sites for storing these commodities have to meet specific requirements regarding ventilation, temperature, humidity, etc. And secondly, why not increase the reserves by purchasing sunflower oil which is easier to store and faster to use when needed?

The only reasonable intervention by the state would be to investigate whether there is a cartel in the domestic market. But the capacity of the Commission for Protection of Competition's to carry out an in-depth inspection is questionable.

In Bulgaria, the sunflower oil business was worth close to 1.5 bln levs (767 mln euro) last year, mainly for exports, and the big players are nearly 15

The temporary panic among buyers has subsided, now the risk is that the state will intervene by stopping exports.

Panic, queues, stockpiling, scuffles in stores. March 2022 has been a crazy month for the sunflower oil market. The reason is the Russian invasion of Ukraine and the fear that the absence of a key player from the market will lead to deficits. And indeed, for a short time, prices of sunflower seeds and cooking oil shocked the world. The panic also hit Bulgaria.