| - Bulgaria's Black Sea resorts will see a drop in the number of visitors in 2019, as tourists choose cheaper destinations like Turkey and Egypt - Early bookings from the two main markets - Germany and Russia, have dropped by 15-20% compared to 2018 - Hotel owners are hoping for last-minute deals, but these will not solve the long- term image problems of the low-cost Bulgarian market |

The last three years were pretty sunny for the seaside tourism industry - revenue and tourist numbers broke records, investment gained pace, new niches appeared and prices and profitability went up. But the halcyon days of recent years, when most hotel rooms for the peak season were already sold out in winter, have ended. And the trend of incremental price increases has turned.

In terms of early bookings for summer 2019, Bulgaria has witnessed a decrease in all of its main markets, and the season is expected to be decided by last-minute bookings, leading to lower revenue.

The main reason for the decrease is structural and easy solutions won't reverse the negative trend. The conditions at Bulgaria's seaside hardly make it competitive in the higher-spending tourist segment. Sadly, Bulgaria's the Black Sea has acquired a reputation for poor service, tacky resorts and substandard facilities. Therefore it has tended to concentrate on attracting lower-budget holidaymakers. This strategy worked well when Turkey, Tunisia and Egypt were facing geopolitical challenges over recent years. However, once these destinations resurfaced on tourist agencies' maps, the flow to Bulgaria dropped significantly. This reveals yet again that the country is not a prime choice destination but rather the second choice, or, as the French would say, faute de mieux (for lack of a better alternative)

Sunburned season

Summer 2019 will be very different from previous seasons. At the end of the early-booking campaign in March, tour and hotel operators on the Black Sea coast reported a drop across all main markets. For the biggest of them, Germany and Russia, it was between 15-20%, about 15% for central European countries and a little over that for Scandinavian visitors. The numbers from the British market, where a large new tour operator is making its debut, pointed to a decrease of 5-6% year-on-year by mid-March.

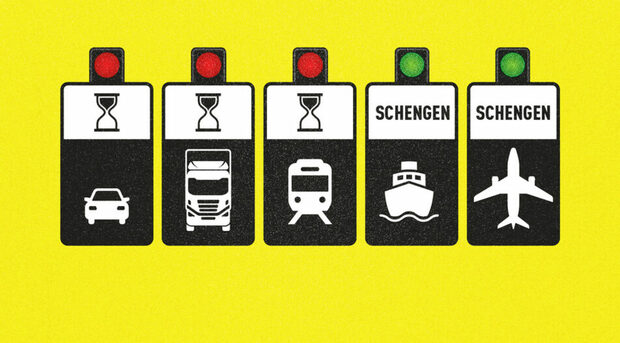

Fraport Twin Star Airport Management which runs Bulgaria's two seaside airports - in Burgas and Varna and, told Capital that the former is expected to serve about 3 million passengers and the latter about 2 million this year. This doesn't sound particularly ambitious - last year, Burgas airport handled 3.28 million passengers, while Varna airport processed 2.28 million travellers. This means that there will be no growth at best and a drop is more likely.

This is in stark contrast to all seasons post-2015. Tourist visits have increased by 7-10% annually which, in addition to rising prices, resulted in a hefty revenue increase for Bulgarian companies in the tourism sector. According to data from the Ministry of Tourism, the sector reaped 8.4 billion levs in revenue in 2018, after topping 8 billion levs for the first time the year before. The revenue from international tourist visits alone reached 7.1 billion levs. "I'm expecting an exceptionally difficult season," remarked Grigor Fidanov, owner of the Grifid hotel chain on Bulgaria's northern Black Sea coast. "We are ready to lower our expectations," said Elena Ivanova, owner of the Imperial Resort complex in Sunny Beach resort, who is also chair of the local association of hotel owners.

Industry experts believe that the drop can be attributed to the recovery of rival destinations. After a series of terrorist attacks and political turmoil in recent years, Turkey lost a lot of tourists. Yet it started to recover in 2017 and a 15% increase is expected this year. Tunisia and Egypt have also returned to the major tour operators' offers and expect a significant rise in visits.

"Bulgaria and Spain are the losers in this situation," believes Ventsislav Tanchev, who represents German tour operator all tours in Bulgaria.

Last-minute expectations

If there is any good news this year, it must be that the tourist sector has become a lot more flexible and has learnt from its mistakes. In previous slow years, hotel owners often kept their initial prices until late, only to hastily decrease them when faced with the prospect of empty rooms. This is bad not only for the hotel owner but for the sector as a whole. Logically, this means that the following year, holidaymakers will push their reservations back, with the expectation of getting a better deal.

According to Dimitar Tachev, deputy director of sales at Albena - the company operating the seaside resort in Northeastern Bulgaria, there was a decrease in early bookings as early as November of last year, and most operators reacted promptly: "Different measures were taken - extending early bookings or more travelling expos."

Extending early bookings and discount offers is a widespread practice in the sector this year. The market even offers early bookings with a rather unusual April deadline. These offers, however, will not offset the drop, and most companies believe that the season will be decided by last-minute bookings. "Bulgaria still has a chance to turn this into a successful season through last-minute sales. There are indications that Turkey is mostly booked up and a lot of hotels are closing reservations. If Turkey gets fully booked, many people could come to Bulgaria or Greece," said Grigor Fidanov.

The government has mentioned subsidies, which would be difficult to achieve, especially for this season. During a Bulgarian-Russian tourism forum in March, Bulgarian prime minister Boyko Borissov suggested that the government has explored options of subsidizing charter flights to Bulgaria as its neighbour Turkey has done. Following PM's announcement, tourism minister Nikolina Angelkova said that a mechanism for subsidizing charter flights would be unveiled soon.

The idea to provide assistance to airlines, in compliance with the exceptionally stringent EU state aid rules, is far from new. During the last slow season, in 2015, the tourism ministry announced the creation of a special fund to aid charter flights for the period it described as "the season´s wings" - April, May, September and October. The idea was for the government to cover part of the expenses related to the opening of new airlines in the first three years, and for tour operators to commit to maintaining them for a further three. This, however, was never more than a project.

The real hurdle

Even if last-minute bookings succeed in partially patching the sector's revenue, they are not a viable long-term strategy for survival, let alone development.

Even though there are significant discrepancies in tourism statistics, the figures still show that the sector is essential to the Bulgarian economy. World Travel & Tourism Council puts the industry's direct contribution to the economy in 2017 at 3.04 billion levs, and 11.4 billion levs or 11.3% of GDP when considering its dependent sectors. The estimate for 2018 is similar. Although no reliable data is available on the exact contribution of seaside tourism, it's more than certain that it is considerable - 70-80% of all visitors, according to expert estimates. This means that a 10% drop would represent a deficit of 800-900 million levs for seaside business.

Hence it is strange that central and municipal government aren't redoubling their efforts to adequately regulate the environment, maintain infrastructure and protect the coast from the construction sprawl. Meanwhile business, instead of searching for ways to upgrade its product, whines about the shortage of tourists.

Every busy season so far has owed its success to problems faced by Bulgaria's competitors. Or, as Kalin Sutev, Rewe Touristic's Bulgarian representative puts it: "We aren't a prime destination, but an alternative." This is what distinguishes Bulgaria from Spain. Sutev explains that the problems facing Spanish tourism stem from increased prices, whereas in Bulgaria the problem runs deeper - a lack of interest in the destination.

Grigor Fidanov believes that in recent years Bulgaria had a "unique historical chance" to make its mark as a steadily developing tourist destination unaffected by geopolitical events in neighboring countries. This may be a bit of an overstatement - it is more than likely that there will be more crises in the future and tourism's global rise is unlikely to slow down, so the chance might not have been exactly historic. That there was a chance missed is indisputable, at least according to forecasts for the current season.

| - Bulgaria's Black Sea resorts will see a drop in the number of visitors in 2019, as tourists choose cheaper destinations like Turkey and Egypt - Early bookings from the two main markets - Germany and Russia, have dropped by 15-20% compared to 2018 - Hotel owners are hoping for last-minute deals, but these will not solve the long- term image problems of the low-cost Bulgarian market |

The last three years were pretty sunny for the seaside tourism industry - revenue and tourist numbers broke records, investment gained pace, new niches appeared and prices and profitability went up. But the halcyon days of recent years, when most hotel rooms for the peak season were already sold out in winter, have ended. And the trend of incremental price increases has turned.