- The ranking is dominated by food and beverage chains occupying the first five positions

- The local units of Schwarz Group companies Lidl and Kaufland generate 36% of the revenues of the top 20 in the sector; the owners of "Technopolis" - 10%, through two chains

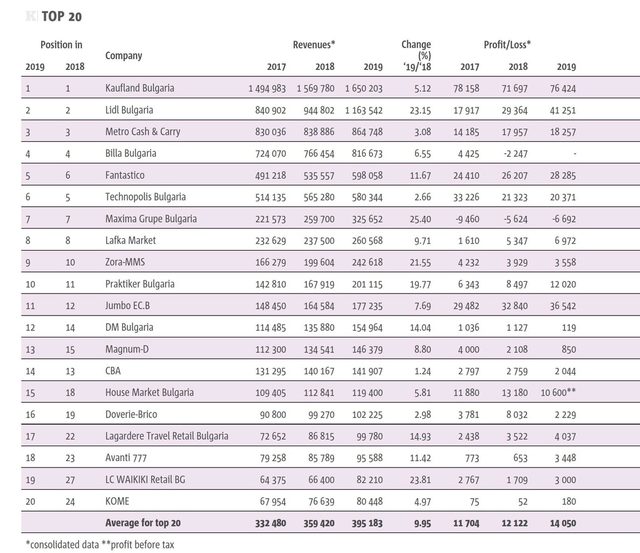

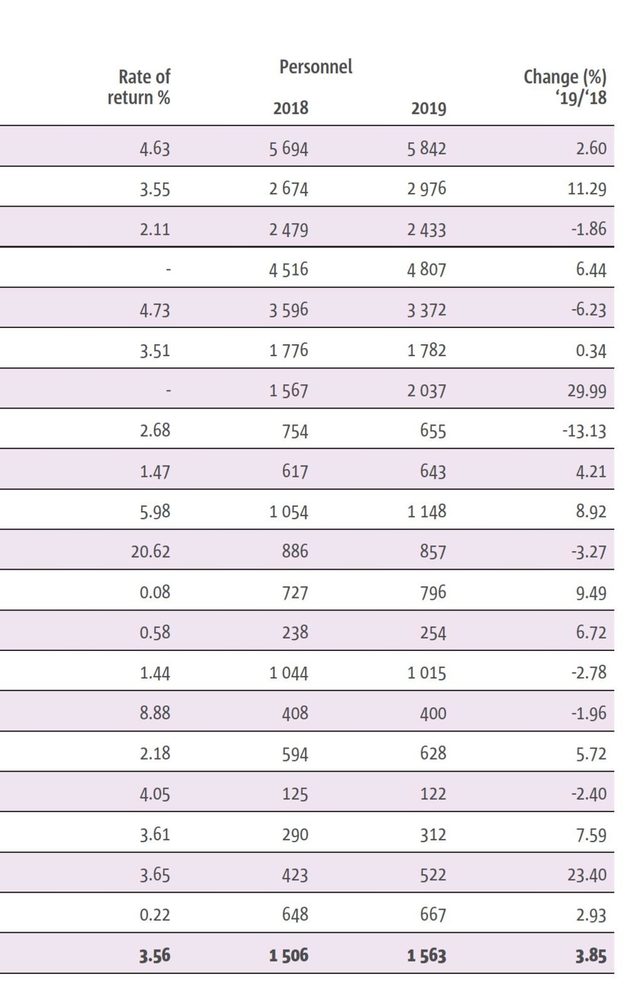

The total revenues of the twenty largest retail chains in Bulgaria in 2019 increased by 10%, reaching BGN 7.9 billion. The growth is two percentage points higher than a year earlier and it will be hard to repeat it this year due to the COVID-19 crisis, especially for traders in non-food products.

The 2019 result is mainly contributed by nine companies. Five of them reported growth of 20%: in the food sector T-Market (25%) and Lidl Bulgaria (23%), in household appliances and electronics - Zora (21.6%), in fashion - LC Waikiki (23.8%), and in the DIY sector - Praktiker (19.8%). The owner of T-Market - Maxima Bulgaria clarifies that the increase in sales revenue is 12.6%, and the rest evidently is generated by other revenues. The parameters achieved by Fantastico and the retailer of cigarettes, alcohol and confectionery Avanti are similar. About 15% is the growth of dm Bulgaria drugstores and the Lagardere Travel Retail Bulgaria.

All top 20 companies posted revenue growth in 2019. The growth of 12 of them accelerated as compared to 2018, while it slowed down for the remaining eight.

Food and beverage chains traditionally dominate among large retail chains. The first five in the ranking and a total of eight are chains of hyper - and supermarkets for fast-moving consumer goods (FMCG). Combined, they generate 71.4% of the total revenue of the twenty largest retailers.

The second place is taken by the three leading equipment chains with a share of 12.3%, followed by excise goods chains with 5.8% and DIY retailers with 3.8%. The other companies, which are leaders in sales of furniture and household goods, drugstores and fashion retailers, account for a total of 7%.

If we review the figures by sectors, the growth rate in DIY chains is the largest - about 13.5%, but it is mainly due to a single player. They are followed by excise goods retailers with 11%, fast-moving consumer goods chains with 10% and traders in domestic appliances and electronics with 7.8%.

The first five

For the tenth year in a row Kaufland (1) is the undisputed leader in retail trade. The company ended 2019 with revenues of BGN 1.65 billion, which is a 5% increase compared to 2018 when it achieved similar growth. Last year's increase, however, was also the result of the opening of new stores. In 2019, Kaufland opened a store in Veliko Tarnovo - its first in the city, following an investment of BGN 25 million, and another hypermarket opened in Varna. Thus, the chain consists of 60 stores in 34 cities. In addition, Kaufland Bulgaria is investing BGN 64 million in the expansion of its logistics base near Plovdiv. Its subsidiary Kaufland Service IT HUB, which is developing technological solutions for Kaufland's German parent company Schwarz Group, opened a second office in Bulgaria.

In 2019, the retailer grew its profit by 6.6% to BGN 76.4 million. The improvement over the previous year is quite visible. Then, according to this indicator, the market leader had a profit decline of 8.3%. For years, Kaufland Bulgaria's profit has been nominally the largest in the retail sector, and the company is among the five companies with the highest profitability in the ranking.

Lidl (2) is the undisputed winner of 2019. The company became the third in the recent history of the sector to cross the BGN 1 billion annual turnover mark after Kaufland and Metro Cash and Carry. Lidl Bulgaria ended 2019 with revenues of BGN 1.16 billion, up 23% year-on-year. Its revenues grew by 12% in each of the previous two years.

In 2019, Lidl Bulgaria opened seven new stores - three in Sofia and some in new locations for the chain, such as St. Constantine and Helena resort, Pomorie and Tsarevo. The last 18 of 60 stores included in the company's renovation program were revamped. At the end of last year, Lidl Bulgaria had 99 stores in 47 cities and started building its 100th store. The goal for this year is four new stores - mainly in Sofia and Varna.

Lidl Bulgaria's profit also increased in the double digits - by 40.5% to BGN 41.3 million, following a rise of almost 64% in 2018.

Obviously, the company is approaching its stated target of becoming the Bulgarian market leader, albeit more slowly than it planned to do by 2020. If Lidl's turnover was half that of Kaufland in 2017, now the two figures differ by one-third? Both companies are owned by Germany's Schwarz Group. Together, they generate 35.8% of the total revenue of the top 20 companies for 2019.

Metro (3) retains its traditional third position among the largest retailers in the country. In 2019, without changing the number of its stores, Metro Cash and Carry Bulgaria increased revenues by 3% to BGN 865 million. The growth results from the development of an assortment? (a product range?) specifically for the needs of the HoReCa sector (the main professional client), and deliveries to clients alongside the main cash and carry model. The growth is higher, compared to the increase of 1% reported for 2018.

Following three straight years of decline, in 2018 Metro Cash and Carry Bulgaria increased its profit by 27% to almost BGN 18 million. In 2019, profit rose again - to BGN 18.3 million.

In 2019, the revenues of BILLA (4) exceeded BGN 800 million for the first time, increasing by 6.6% to BGN 816 million. In the previous year, revenue grew by 5.9%. Billa Bulgaria did not provide data on its bottom line. In 2018, it reported a loss for the first time (BGN 2.2 million).

Having 131 supermarkets in 38 cities, Billa remains a leader in the number of outlets among retailers in Bulgaria. In 2019, it opened eight new stores, bringing the total number to 130 at the end of the year. The retailer has 13 supermarkets situated in shopping malls. It plans to open six new stores this year and seven next year.

Last year, the CEO of Billa Bulgaria, Boyko Sachanski, was replaced by Norbert Misbrandt who until then had been chief operating officer at Billa's Czech branch.

The smooth progress of "Fantastiko" (5) continues. In 2019, the revenues of the retail chain increased by 11.7% to almost BGN 600 million. For comparison, revenues grew by 9% in the previous year. The company's profit also rose last year - by almost 8% to BGN 28 million. In the previous year, profit grew by 7.4.

In 2019, the chain invested BGN 35 million in its retail network. It opened a new store in Dragalevtsi, and at the site of the old one, it opened a shopping centre and renovated two stores. At the end of the year, it owned 42 stores - mainly in Sofia, but also in Elin Pelin and Kyustendil. This year, Fantastico opened stores in Sofia and Bankya, and has plans for expansion in Pernik next year. Fantastico employed 3372 people as at end-2019, 6% fewer compared to the previous year due to process optimization and outsourcing of activities.

The Rest in the Food Sector

Maxima Bulgaria's total revenues grew by a quarter to BGN 325.7 million during the year. The company also said that the sales of its T- Market (7) stores increased by 12.6% to BGN 292.4 million, making Bulgaria the second fastest-growing market in Maxima Grupe after Poland.

In August, Maxima announced that they would lease 11 of the former stores of Plovdiv-based supermarket chain Triumph, which will be reconstructed, rebranded and gradually put into operation. At the end of 2019, there were 82 T-Market stores, located in 38 cities. A total of eight new stores were opened last year. Excluding new sites, revenue grew by 4.7% in 2019, Maxima said, noting that this is ahead of the average growth of the market of 3.7%.

The company, which is in the process of active expansion in Bulgaria, increased its net loss to BGN 6.7 million in 2019, compared to BGN 5.6 million loss for the previous year. Employees of Maxima Bulgaria increased by almost 30% last year, reaching 2307.

The revenue growth of the two regional chains in the ranking slowed down: Varna-based CBA, with a logistics base in Veliko Tarnovo and stores in Sofia, and Kome, whose stores are located in Sofia, Dupnitsa, Pernik, Ihtiman, Kostinbrod, Slivnitsa.

In 2019, the turnover of CBA (14) increased by only 1.24% to BGN 142 million, while in the previous two years it grew by about 7%. The profit, which in 2017 soared by 121%, in 2018 remained at the same level of BGN 2.76 million and decreased by almost 26% year-on-year to BGN 2 million in 2019.

"Kome" (20) ended the year with a 5% growth in revenues - to BGN 80.5 million, which, however, is its weakest result in three years. Profits almost doubled, starting from a low base.

Domestic Appliances and Electronics

The 7.8% revenue growth of the retail chains selling household appliances and electronics in 2019 was is somewhat slower than the average for the top 20. This is mainly due to the slower revenue growth of the sector leader - Technopolis Bulgaria (6), whose turnover, however, is more than twice that of the ambitious second-ranking chain. The problems of the former leader - Technomarket (the company did not provide any data) opened the way for rapid development of two smaller companies owned by Bulgarians -Zora (9) stores and Magnum - D" (13) which owns the Techmart chain.Technopolis Bulgaria is owned by Bozhidar Kolev and Todor Belchev through Videolux Holding. They also own local DIY retailer Praktiker (10). The aggregate turnover of the two companies contributed to almost 10% of the revenue in the top 20 groups in 2019. After a 10% rise in revenue in 2018, Technopolis achieved only a 2.7% growth in 2019 - to BGN 580 million. This drop-in revenue is the reason why Technopolis was replaced in its traditional fifth position among the largest retailers by Fantastico. In 2019, Technopolis managed to rein in the decline in profit. In 2018, profit decreased by 36%, but in 2019 the fall decelerated to 4.5% year-on-year - to BGN 20.4 million. Technopolis is the most profitable company among the equipment chains.

Zora stores (9) have been increasing their revenues by about 20% a year for three years in a row. The growth achieved in 2019 was 22%. During the year (Zora- MMS) opened a new store, bringing the total number of its outlets to 37 located in 25 cities. The retailer also has an online store. The company's profit has been declining for two years in a row.

In 2019, Techmart's (13) revenues increased by 8.8% to BGN 146 million, after growing by 20% the year before. The profits at Magnum -D (the owner of Techmart) have halved for a second consecutive year. The chain opened a new store last year, bringing the total number of its outlets to 13 located in eight cities. It also runs an online store. Magnum - D started as a representative of several brands of household appliances and electronics. Seven years ago it began retailing and created Techmart.

Excise goods chains

The average growth of the three excise goods retailers in the ranking is 11% - above the average for the top 20. For Lafka (8), 2019 was more successful than the previous ones. At the beginning of 2020, however, after six years on the market, the chain connected to a member of parliament Delyan Peevski, was closed. The decision is the result of the plunge in revenues due to the suspension of the sale of lottery scratch tickets (a business held by indicted businessman Vasil Bozhkov) and the decision of the state to take over the distribution of newspapers and magazines. In recent years, Lafka Market had built a network of 1059 kiosks in the country, including 824 franchises. It signed a concession agreement for the public transport stops in Plovdiv. In 2019, revenues increased by 9.7% to over BGN 260 million. Profit rose by 30%. However, this was the last participation of the company in the ranking. It is expected that the wave of nationalization by the government will continue and the state lottery will somehow acquire the kiosks.The largest revenue growth in 2019 among the excise goods retailers was achieved by "Lagardere Travel Retail" (17). The company is a subsidiary of France's Lagardere Travel Retail - the global leader in trade in transport and passenger areas, which in Bulgaria operates stores under the Inmedio, Relay, 1 Minute, Discover Bulgaria brands. In 2019, Lagardere's revenues from operations in Bulgaria grew by 15% to almost BGN 100 million, which was below the level of growth of 19.5% achieved in the previous year.

In 2019, Avanti (18) improved its results compared to the previous year. Sales of Avanti 777 rose 11.42%, reaching BGN 95.6 million, compared to an increase of 8.2% in 2018. The profit quadrupled up to BGN 3.45 million. Avanti operates 40 stores in Sofia, Varna and Burgas and has 28 franchises

DIY

The two companies representing the Do-It-Yourself (DIY) sector have an average growth of 13.5% in 2019 - well above the market average. It is mainly due to leader Praktiker (10).Praktiker Retail is owned by Technopolis, which acquired it six years ago. In 2019, Praktiker's revenues increased by 19.8%to BGN 201 million. The profit reached BGN 12 million, up 41.5% year-on-year. The chain has 12 stores in 11 cities. New outlets in Pazardzhik and Dobrich are under construction.

Mr. Bricolage (16) slowed its sales growth to about 3% in 2019, compared to over 9% a year earlier. After Doverie Brico's profit doubled to BGN 8 million in 2018, it 2019 it declined to BGN 2.2 million. The employees at the headquarters and the stores in seven Bulgarian cities increased by 34 people to 628 last year.

In the ranking for 2018, Baumax Bulgaria was several positions above Doverie Brico but now there is no 2019 data available for this company.

Four More Majors

The household goods and children toys chain JUMBO (11) slowed the growth of its revenues. If in 2018 the revenues rose by 11% (half of the growth rate achieved in the previous year), in 2019 they grew by 7.7% to BGN 177 million. Jumbo S.B maintained a steady pace of profit growth of about 11% in each of the last two years. The chain traditionally has the highest return on revenue among large retailers - 20.6%. JUMBO has nine stores located in the six largest Bulgarian cities. It plans to build a fifth store in Sofia, in the industrial zone of Iliyantsi district, within two years.The growth of the income of the leader among the home furnishing retailers - IKEA (15), is gradually accelerating. In 2019, it was 5.8% (compared to 3% the previous year), reaching BGN 119.4 million. However, the profit of House Market Bulgaria (PLEASE, EXPLAIN THE LINK BETWEEN IKEA AND HOUSE MARKET) decreased by almost 20% to BGN 10.6 million - the lowest in the last four years, after growing by 11% in 2018.

Operating a store in Sofia and order centres in Varna, Burgas and Plovdiv, the chain holds 10% of the home furnishing market in Bulgaria, according to its management. It opened a second store in Bulgaria this fall - in Varna. The new store is medium-sized and will add 120 jobs to the existing 400.

It is not surprising that Germany's dm (18) remains No,1 drugstore chain on the Bulgarian market. The company operates 73 stores in 25 cities in Bulgaria. Last year, its revenues increased by 14% to reach almost BGN 155 million. However, the pace slowed down, compared to 18.7% growth the previous year. The company's profit fell by almost 9% last year - to BGN 119,000.

The fashion sector is represented in the ranking by LC Waikiki (19) which had a very strong year in all aspects in 2019. The brand, which started in France and continued as a Turkish one, was number three fashion brand in the ranking for 2018 - far behind H&M and immediately after Zara. However, there is still no data available on the performance of Zara and H&M in 2019.

LC Waikiki's revenues reached BGN 82.2 million last year, up 24%. The increase is similar to the growth of 23% achieved in 2017 and a sign of recovery after 2018 when revenue grew by only 3%. In 2019, the company's profit rose to BGN 3.0 million, compared to BGN 1.7 million a year earlier. LC Waikiki operates a network of 24 stores located in malls, shopping centres and retail parks in 14 Bulgarian cities and has an online store.

- The ranking is dominated by food and beverage chains occupying the first five positions

- The local units of Schwarz Group companies Lidl and Kaufland generate 36% of the revenues of the top 20 in the sector; the owners of "Technopolis" - 10%, through two chains

The total revenues of the twenty largest retail chains in Bulgaria in 2019 increased by 10%, reaching BGN 7.9 billion. The growth is two percentage points higher than a year earlier and it will be hard to repeat it this year due to the COVID-19 crisis, especially for traders in non-food products.