• Most of the foreign investors in Bulgaria expand their operations, but the new investors are quite a few.

• More than one-third of the companies in the ranking have Bulgarian owners.

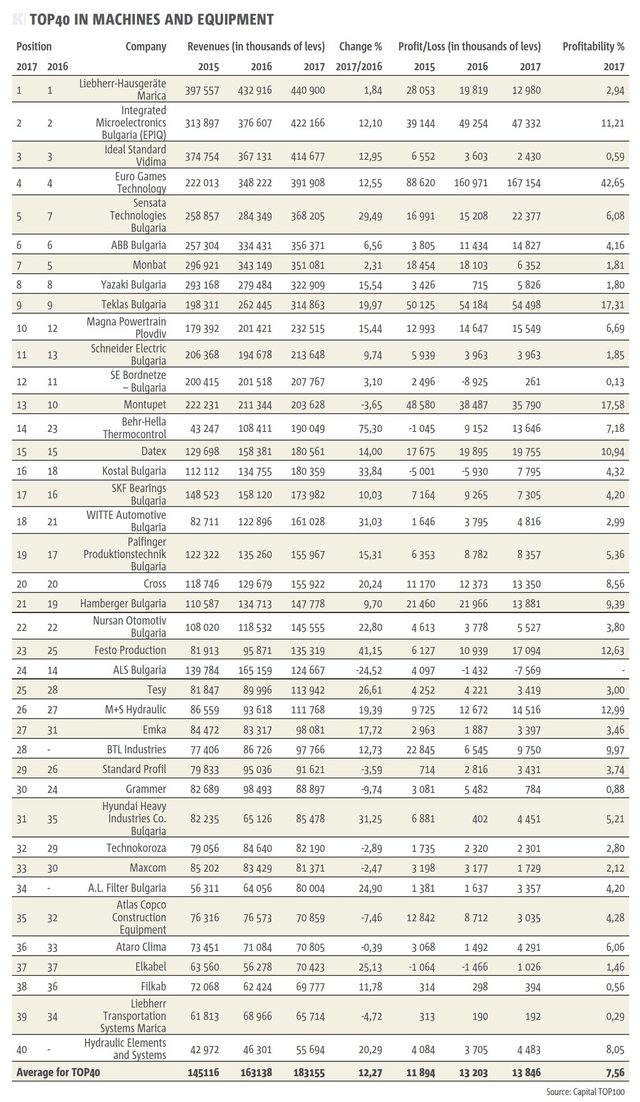

A common misconception holds that Bulgaria doesn't produce much, yet some sectors of the country's economy are growing rapidly and hiring more than ever. The combined revenue of the top 40 companies in the sector of manufacturing rose to 7.3 billion levs last year, up 12% on 2016, exceeding seven billion levs for the first time after topping six billion levs for the first time in 2016.

The average revenue of the companies in the TOP 40 group of the Machines and Equipment segment of Capital's annual ranking is on the rise as well, reaching 183 million levs. This group does not include the arms manufacturers which are part of another ranking. Only nine companies have registered slower revenue growth even though the average growth rate remained at 12%.

The net number of employees has grown from 42,000 in 2016 to 43,000 in 2017, again excluding arms manufacturers who are large-scale employers.

Third-time champion

For the third straight year Liebherr-Hausgeraete Maritsa ranks first. The revenue of the Bulgarian unit of the German manufacturer of refrigeration equipment maintains its steady rise, having grown by 20% in four years. The company employs over 1900 people and plans to produce over 920,000 refrigerators and freezers in the current year. The main goal of the holding company Liebherr is to reach annual production of one million appliances in Bulgaria. The group has also expanded its IT department and continues to hire software developers for development and implementation of new systems. The aggregate revenue of all units of Liebherr in Bulgaria, which also include Liebherr Transportation Systems Maritsa, exceeds one billion levs.

Integrated Micro-Electronics Bulgaria comes second in TOP 40 for a second year in a row with 416 mln. levs in revenueThe Botevgrad-based electronic components manufacturer, which mainly serves the auto industry, has been quite successful. The company, part of the Philippines-based group Integrated Microelectronics (IMI), has slowed its net income growth to 12% in 2017 from 17% in 2016. Projections for 2018 forecast a more balanced growth rate, due to a 25 million levs investment project completed during 2017. The company employs around 3000 in Bulgaria, and IMI's next investment in Serbia is to be controlled by the Bulgarian management team.

Bathroom fixture manufacturer Ideal Standard remains third. After being first for several years, the Sevlievo-based company suffered two years of increasingly slowing growth. Yet, in 2017 they've managed to grow revenues by 13% to 414 million levs. Investment in Ideal Standard - Vidima topped 22 million leva in 2016, and there are plans to triple this volume before 2019, with an end-goal of 30% annual growth. According to the CEO of Ideal Standard - Vidima, Yaroslav Donchev, the investment drive is targeting the company's three manufacturing facilities - one for sanitary ceramics and two for taps and fittings. Investment in Sevlievo is part of Ideal Standard International's global strategy for expansion of their market share in Europe. Ideal Standard International Group announced earlier this year that an entity managed and advised by Anchorage Capital Group and CVC Credit Partners have completed the acquisition of the group, becoming its sole shareholders.

Close behind follows the rapidly growing gambling games manufacturer Euro Games Technology, a Bulgarian company that's been in market for 16 years. Today it serves customers in over 80 countries worldwide and owns subsidiaries in Romania, Hungary, Spain and elsewhere. The company grew revenues by 57% in 2017, increasing its cash flow by 12% year-on-year to 392 million levs. Most impressive, however, is its profits which is equal to more than 43% of its revenue. Euro Games Technology has almost 1200 employees and is hiring software experts.

Automotive parts

The manufacturing of components and parts for the automotive industry remains the backbone of the machine building sector in Bulgaria, the new rankings show. There are over 16 representatives of the sector in this year's rankings, with total revenue of 3.48 billion levs, or almost half of the TOP 40 revenue in the Machines and Equipment segment. Only four of these companies registered a drop in revenue in 2017 relative to the previous year.

The biggest drop in revenue was recorded by automobile upholstery manufacturer ALS Bulgaria which has three factories in the country. ALS, which is owned by South African investors, faces a shortage of skilled workers, which slows down output just as demand from BMW and Mini hits new heights. Although the company has increased its staff by 30% to 1600 people, according to their head manager, Shaun Bosch, there are hundreds of vacant positions in the company. "If we could find enough people we would have already opened a fourth factory," Bosch said several months ago. Over 10% of workers regularly don't show up on time, which drastically slows production.

Another company that registered a drop in revenue in 2017 is the local unit of French manufacturer of cast aluminium car parts Montupet, whose revenues fell by 4%. The company has several factories, the biggest being located in the city of Ruse, and its main clients include Audi, BMW, Ford, Volvo and Renault.

The automotive parts manufacturer with the largest workforce in the ranking is Yazaki Bulgaria, which currently employs over 5700 people. In 2017, the company, part of Japanese car parts manufacturer Yazaki, opened its third factory in Bulgaria, in the town of Dimitrovgrad. The heightened production rate is reflected in Yazaki Bulgaria's total revenue , which topped 300 million levs in 2017 for the first time, landing at 323 million levs, up 15% on 2016.

The fastest growing company in this segment is Germany's Behr-Hella Thermocontrol, which is operating a production plant manufacturing cooling systems for BMW, Volkswagen and other car makers. The Bulgarian operation in Bozhurishte, on the outskirts of Sofia, was launched two years ago and generated 190 million levs revenue last year, up 75% on 2016. Behr-Hella Thermocontrol keeps increasing its profits and its team already exceeds 300 people, of whom 50 work for its R&D department. The Bulgarian branch of the company announced in June that a plan to increase the output of its Bozhurishte factory by 80% is being implemented. With this strategy in mind it's easy to imagine Behr-Hella Thermocontrol joining the top 10 group in the ranking soon.

Another company that keeps growing is the Bulgarian unit of US-based manufacturer of sensor devices for the automotive industry Sensata Technologies. The revenues of Sensata Technologies Bulgaria rose by 30% to 368 million levs in 2017. The rapid growth is likely due to the opening of a new factory near Plovdiv in 2016. The data shows that the new factory is expanding its activity, evidenced by the steady rise in staff numbers, which have gone up by almost 50% to 2700 people. In 2017, the company also opened its biggest test lab, which serves as a main research and development hub. Over $3 million was invested in the Sofia-based lab. Some of Sensata's biggest clients include Volkswagen, Daimler, Fiat, Volvo and General Motors.

The Bulgarian unit of German manufacturer of car locking systems WITTE Automotive also reported robust growth last year. After making its debut in TOP 40 last year, Ruse-based WITTE Automotive Bulgaria saw its revenue grow by 31% to 161 million levs in 2017. The company staff also increased, exceeding 800 employees. Currently, the company is implementing a three-year programme that includes an upfront investment of 10 million euro and aims to double the company's cash flow. Daimler, Ford, Volkswagen and Volvo are among the clients of WITTE Automotive Bulgaria.

Diesel particulate filter manufacturer A.L. Filter, a subsidiary of Israeli group AL Filter, makes a debut in the ranking after its revenue rose by 25% year-on-year to 80 million levs in 2017. Ruse-based A.L. Filter has been in market since 2002 and is the best performing unit within the group.

The best of the rest

The remaining participants in TOP 40 are companies from a multitude of different industries producing anything from hydraulic systems to medical equipment. A company consistently expanding its business is Festo Production, a part of German concern Festo that focuses on industrial automation. Festo Production's plant in Sofia is manufacturing magnetic sensors and is increasing steadily its production capacity.

Tesy is one of Bulgaria's most successful manufacturers. The company is part of Ficosota Holding, which produces electric water heaters, panel heat convectors and oil-filled radiators. In 2017, the Bulgarian company increased its cash flow by 26% to 114 million levs and sold over one million items of its product range in over 55 countries. Around 90% of Tesy's output is exported to countries like The Netherlands, Slovakia and Spain. The company keeps investing in its Bulgarian infrastructure. Recently, it invested eight million levs in its factory near Shumen with the aim of expanding its production capacity. Tesy is heading in the "smart home" direction, as most of their products integrate a Modeco Cloud technology allowing for remote control of household appliances by means of a smartphone.

Another company entering our ranking for the first time is the Bulgarian unit of BTL Industries, a Czech manufacturer of medical equipment. The holding company operates in 120 countries around the world and is leader in the production of physiotherapy equipment. The Bulgarian branch is based in Plovdiv, manufacturing mainly cardiology equipment. Separate from the Plovdiv factory is the Sofia-based engineering team with over 30 specialists. The company aims to manufacture itself most of the parts that it uses in its end-products.

Two companies, both part of holding company Stara Planina Hold, reported 20% revenue growth in 2017 - M+S Hydraulic and Hydraulic Elements and Systems. M+S is ranked the world's fourth biggest hydraulic motor manufacturer with a global market share of almost 9%. The Kazanlak-based M+S Hydraulic exports to Europe, South and North America, Australia and Asia. Hydraulic Elements and Systems is a producer of hydraulic cylinders and operates a production plant in the city of Yambol. In 2017, the company grew its revenue to 56 million levs.

Bulgaria's two biggest bicycle manufacturers, Cross and Maxcom, operate in a strongly competitive global market. Cross reported a 20% rise in revenue to 156 million levs in 2017, while Maxcom recorded a slowdown of growth of 2% that put its revenue at 81 million levs. The Bulgarian bicycle manufacturing sector remains heavily dependent on intermittent imports from Asia which often disrupts production and makes the market fairly volatile. Both companies have started to develop electric bicycles.

• Most of the foreign investors in Bulgaria expand their operations, but the new investors are quite a few.

• More than one-third of the companies in the ranking have Bulgarian owners.