With net written premiums of one billion euro per year, 70% of which come from compulsory motor third-party liability cover, the Bulgarian insurance market is small and underdeveloped. Strong competition among 29 insurers in the non-life sector and a further 13 in life insurance makes it difficult to grow and flourish in this business. In such environment and with tougher regulations requiring more and more capital, several insurers have decided to expand abroad and benefit from the EU-wide freedom of movement of services.

Euroins has advanced the most in this respect with operations in 10 countries and DallBogg (God Gave in Bulgaria) is catching up with the recent launch of operations on the Romanian car insurance market. Until recently Nadejda (Hope) was also among those international players. It had a strong presence on the Italian market but Bulgaria's Financial Supervision Commission (FSC) revoked its license. The radical sanction was imposed after last year's checks of the sector which exposed some worrying findings that have not been properly addressed since. The prompt action was explained with the increased responsibility of the local regulator for insured parties abroad. This raises the question whether the FSC will extend its firm stance towards other insurers and will their business abroad be influenced by the reputational issue.

The Nadejda case

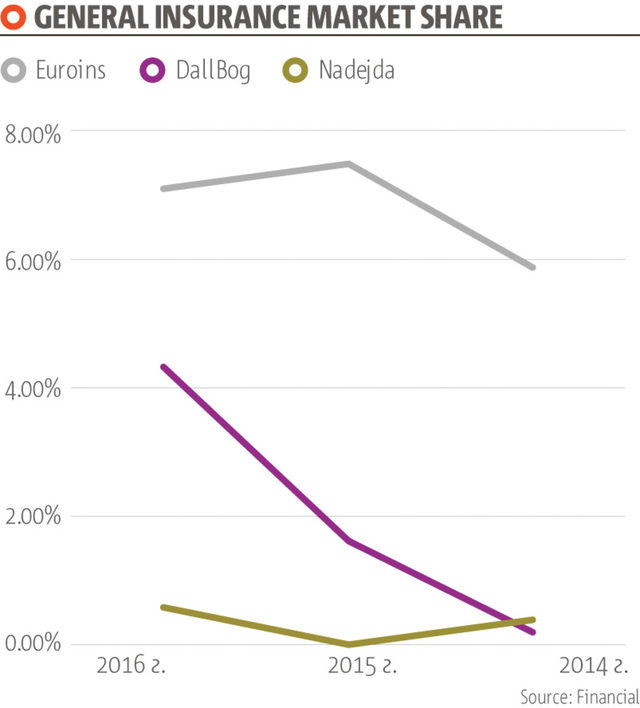

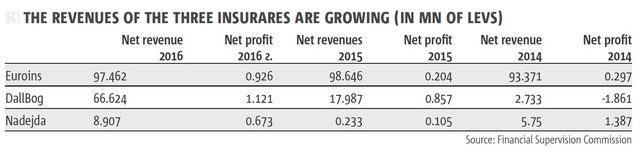

Founded some 13 years ago, Nadejda has always been among the smallest players on the Bulgarian insurance market. Specialized in health insurance, it has won as its clients employees of public institutions such as the Armed Forces and state-owned enterprises such as the National Electricity Company and Kozloduy nuclear power plant. In the summer of 2016 Nadejda was licensed to sell financial insurance policies in Italy. These products covered the risk in public procurement operations. Beneficiaries of such policies were public institutions, for instance the Government of Rome and the Municipality of Milan. Just for six months the company reaped almost four million euro in premiums in Italy, which boosted significantly its market position. With written premiums of 100,000 euro in 2015, Nadehda ended 2016 with 4.5 million euro premium income equivalent to 0.6% market share in Bulgaria. But the joy of this rapid rise was short-lived. In August 2017 the FSC revoked Nadejda's license, banned the sale of insurance products for six months and prohibited the free disposal of the assets of the company. With this decision the regulator pushed the company towards liquidation.

The reason for these measures were some alarming findings made during last year's balance sheet review of Bulgarian insurers. During the checks the appointed external auditor, Mazars, concluded that Nadejda had over-priced assets and under-priced obligations. This led to significant reduction of the insurer's solvency parameters, which already came in below the minimum requirements. The capital shortage was estimated at 1.3 million euro, which the owner of the company, Victor Serov, decided to compensate by depositing money as subordinated term debt. The regulator refused to approve the move.

Another disturbing finding was that Nadejda wasn't building up technical provisions for its Italian insurance policies. The reserves figure was zero because the model is unique and doesn't pose any risk at all, Victor Serov claimed. But the regulator estimated that with an average damage rate of 40% in financial insurance Nadejda's Italian portfolio could lead to claims of 120 - 130 million euro. So, the FSC stopped the company's business by revoking its license.

Serov said that he would take the regulator to court over its decision. He suggested that clients who decide to cancel their contracts with Nadejda now will suffer losses. This explains why some of the insured parties in Bulgaria declared that they would wait until their contracts expire, as the absence of license doesn't take responsibility off the company. Meanwhile, there is an option for the Italian portfolio to be sold but it can be only forced by the FSC, said Serov.

What about the others?

The regulator's firm policy that dampened the expansion enthusiasm of Nadejda could reflect on other insurance companies looking for growth in other European countries. Euroins has spread its business across Europe and intends to expand further. The group has a large division in Romania, which is its main market, and it is also operating in Macedonia, Poland, the Czech Republic, Italy, Slovakia, Spain, Ukraine and Greece. In August the FSC sent a letter to its Greek counterpart, informing it that Euroins intends to set up a branch there.

A couple of months before that, Euroins acquired an insurance portfolio from ATE Insurance Romania, a Piraeus Bank subsidiary, which added less than 1% to its market share. The transfer of the portfolio was motivated by diversification: Euroins is the biggest player on the Romanian car insurance market and now will have exposure to property insurance, insurance against fire and natural disasters, civil liability insurance. Another important step for the company was the regulatory approval for a capital increase - by 22 million euro to 117.9 million euro. The company has been in a financial recovery procedure for more than a year after an asset quality review revealed a number of weaknesses in solvency and capital.

Another insurer with a bold expansion strategy is DallBogg. Launched as a health insurance company, it entered the competitive auto insurance market. In just one year the diversification move resulted in a huge increase of the company's domestic market share - from 1.6% in 2015 to 4.3% at the end of 2016. In February DallBogg received an approval from Romania's Financial Supervisory Authority to start selling compulsory car insurance policies in Romania. The company targets a 2% market share in Romania in the first year of operation.

With net written premiums of one billion euro per year, 70% of which come from compulsory motor third-party liability cover, the Bulgarian insurance market is small and underdeveloped. Strong competition among 29 insurers in the non-life sector and a further 13 in life insurance makes it difficult to grow and flourish in this business. In such environment and with tougher regulations requiring more and more capital, several insurers have decided to expand abroad and benefit from the EU-wide freedom of movement of services.

Euroins has advanced the most in this respect with operations in 10 countries and DallBogg (God Gave in Bulgaria) is catching up with the recent launch of operations on the Romanian car insurance market. Until recently Nadejda (Hope) was also among those international players. It had a strong presence on the Italian market but Bulgaria's Financial Supervision Commission (FSC) revoked its license. The radical sanction was imposed after last year's checks of the sector which exposed some worrying findings that have not been properly addressed since. The prompt action was explained with the increased responsibility of the local regulator for insured parties abroad. This raises the question whether the FSC will extend its firm stance towards other insurers and will their business abroad be influenced by the reputational issue.